Hey, someone has to pay for this $8 trillion dollar AI factory build out.

For a while, Big Tech did what Big Tech always does when it sees a once-in-a-generation opportunity. It reached into the couch cushions. Cash. Lots of it. Years of profits, buyback discipline, and balance-sheet conservatism meant the early phase of the AI data-center boom could be funded without much drama. New campuses went up. GPUs got ordered. Power deals got signed. The message was simple: we’ve got this.

Turns out, they didn’t. Not with cash alone, anyway.

As the scale of the AI buildout came into focus, the appetite quickly outgrew even the largest war chests in corporate history. These aren’t incremental upgrades or the usual capex cycles. These are factories. AI factories. And they are expensive in ways this industry hasn’t had to fully confront before. So Big Tech did what capital markets are designed to enable. It borrowed. A lot.

Over the past year, the largest technology companies rang up close to $110 billion in debt offerings. Not because they were distressed. Not because they couldn’t access capital. But because the AI data-center arms race demands funding at a scale that changes behavior. It changes priorities. And increasingly, it changes headcount.

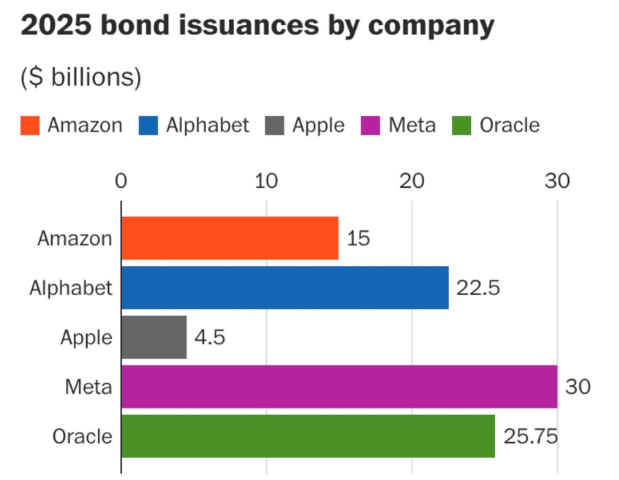

Big Tech 2025 bond issuances.

Source: Moody’s Analytics/Aaron Gregg/The Washington Post.

If you want to see that shift in black and white, the bond issuance numbers tell the story. Meta, Alphabet, Oracle, Amazon. All dipping into the same well. Different business models, different narratives, same conclusion. Cash was not enough. Debt became the next lever.

Now comes the part that’s getting less comfortable. The layoffs.

Last week, Amazon became the latest company to announce significant job cuts, as reported by The New York Times in a piece that is behind a paywall but worth reading if you have access. The company disclosed plans to eliminate roughly 16,000 more corporate roles. That’s on top of the 14,000 cuts announced just a few months earlier in October.

Let’s be clear about what this is and what it isn’t. This is not a story about AI replacing workers at scale. Not yet. This is not warehouses suddenly emptied by robots or delivery drivers swapped out by autonomous fleets. In fact, some of the hardest-hit roles are software developers. Engineers. Product teams. Even parts of AWS were not immune.

These are good jobs. High-paying jobs. Skilled jobs. The kinds of roles that power innovation and, ironically, help build the very AI systems now commanding so much capital. They are the kinds of jobs that AI is supposed to create. The bread and butter of making up upper-middle-class neighborhoods and trendy urban centers.

Amazon isn’t alone. Across the sector, companies are quietly tightening belts while loudly touting AI ambitions. The message to Wall Street is discipline. The message to employees is murkier. The result is a growing realization that layoffs are being used, at least in part, to help fund AI infrastructure. Not because AI has eliminated the need for these workers, but because the balance sheet has to make room.

And these decisions don’t stop at one company’s doors.

UPS recently announced plans to shed roughly 30,000 jobs, citing reduced delivery volume from its largest customer. Amazon. When you put those numbers together, nearly 60,000 jobs are tied directly or indirectly to one company’s strategic pivot. That’s not a rounding error. That’s a ripple moving through the labor market.

We’ve covered the AI buildout before. The sheer demands on energy and water. The land grabs for suitable sites. The reality is that data centers, once built, don’t employ nearly as many people as the hype suggests. Construction booms create temporary jobs. Operations teams are lean. Highly automated. Permanent employment gains are limited.

We’ve also talked about the broader implications. Digital sovereignty. AI sovereignty. The uncomfortable questions governments are asking as they realize that control over compute is becoming as strategic as control over oil once was. These AI factories are the infrastructure of a new Industrial Revolution. Whether you like that framing or not, it’s increasingly accurate.

And they are table stakes. You don’t get to opt out if you want to compete at the top tier. That reality is driving decisions that, a few years ago, would have seemed unthinkable. Massive debt loads for companies that once prided themselves on fortress balance sheets. Workforce reductions are not tied to revenue collapse, but to capital allocation.

This is where the story gets real.

It’s one thing to talk about AI in abstract terms. Models. Agents. Productivity promises. It’s another thing to watch debt rise and jobs fall in service of that promise. When worshipping at the AI cathedral, the altar looks different when you are tied to it as the next sacrifice.

Shimmys Take

None of this means the AI bet is wrong. History is full of moments where transformative infrastructure required painful transitions. Railroads. Electrification. The internet itself. Each came with dislocation before dividends. The question is not whether AI will matter. It already does. The question is whether the pace and scale of this buildout are being matched by realistic expectations about returns, jobs, and social impact.

There’s also a risk here that doesn’t get enough airtime. Rising interest rates make debt more expensive. Data-center returns depend on utilization that assumes demand keeps growing. If the AI revenue curves don’t materialize as quickly as hoped, those balance sheets get heavier. Flexibility shrinks. The margin for error narrows.

Are we rushing headlong into a dead end, as some critics argue? Or will this all be justified by a pot of gold at the end of the rainbow? That’s a debate I’m spending more time on, and it deserves its own column.

For now, what’s undeniable is this. The AI factory buildout has moved from theory to reality. From press releases to bond markets. From aspirational job creation narratives to very real layoffs. Big Tech is making its bet. It’s borrowing to do it. And workers, at least in the short term, are helping pay the price.

That doesn’t make the bet wrong. But it does make it real. And when bets get this big, everyone should be paying attention.